1031 tax deferred exchange meaning

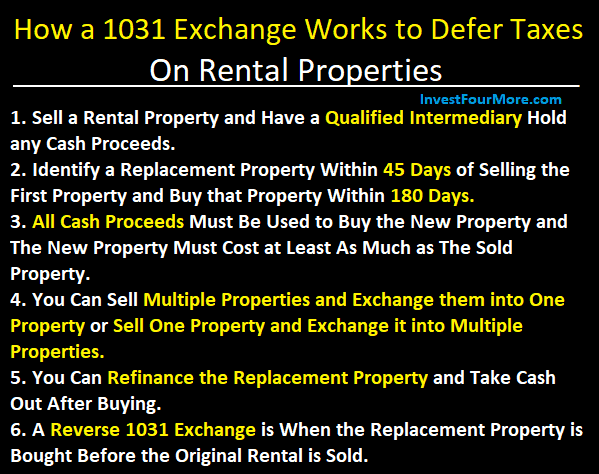

A 1031 exchange gets its name from IRC Section 1031 which allows you to avoid paying taxes on any gains when you sell an investment property and reinvest the proceeds into. Thanks to the 1031 exchange you can reinvest the profits into.

1031 Exchange And Primary Residence Asset Preservation Inc

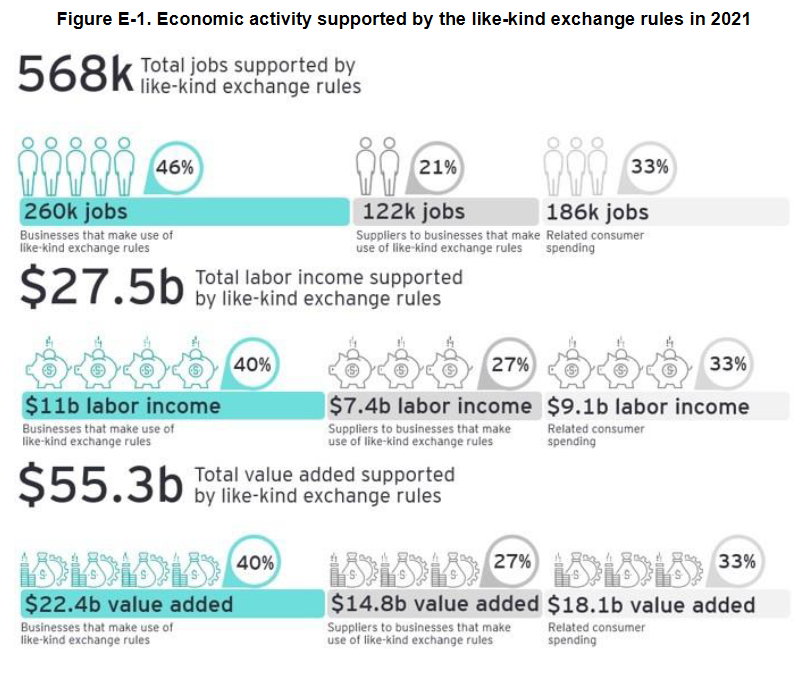

Value of 1031 Exchanges.

. Our expert advisors can help. Internal Revenue Service Code that allows investors to defer capital gains taxes on any exchange of like-kind properties for business or. A tax deferred exchange is a transaction that permits taxpayers to sell an asset held for investment or business purposes use the proceeds to purchase a like kind investment and.

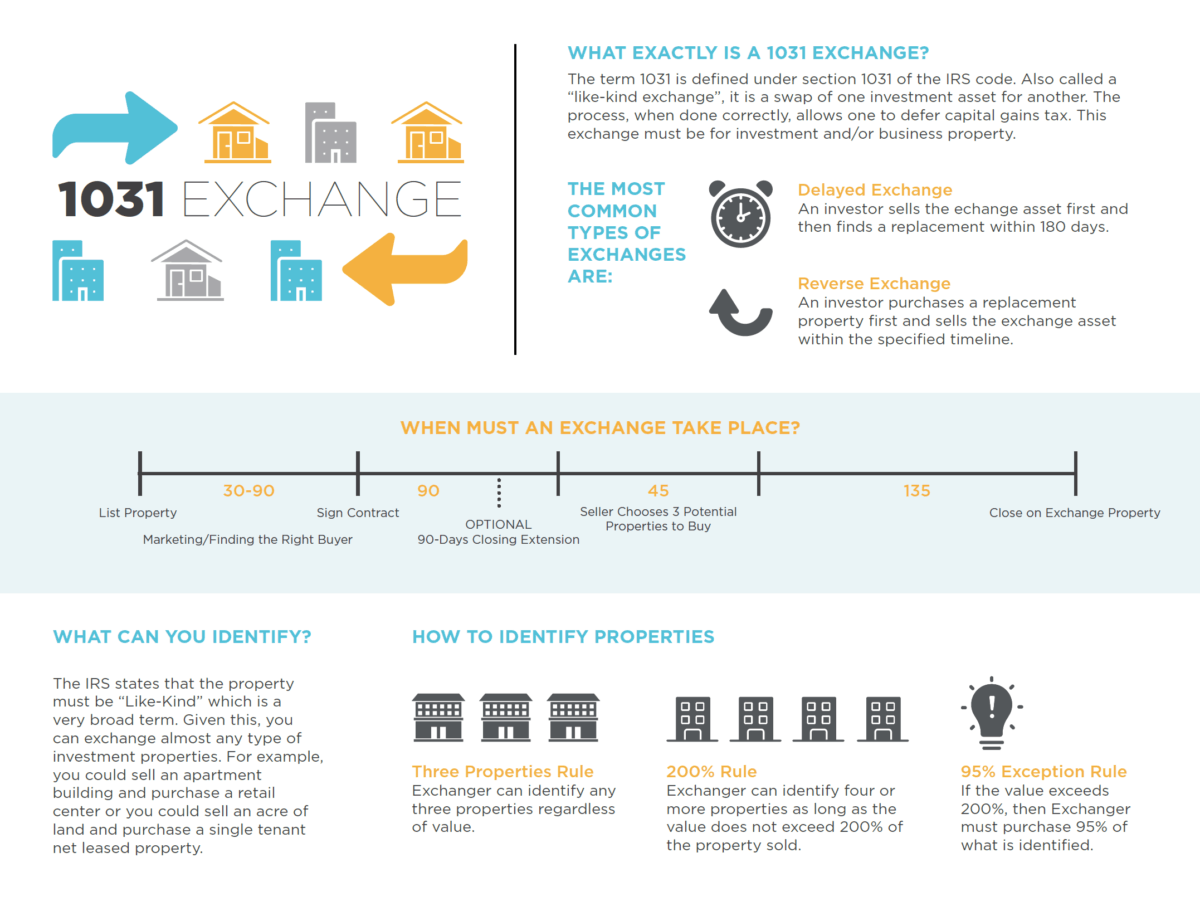

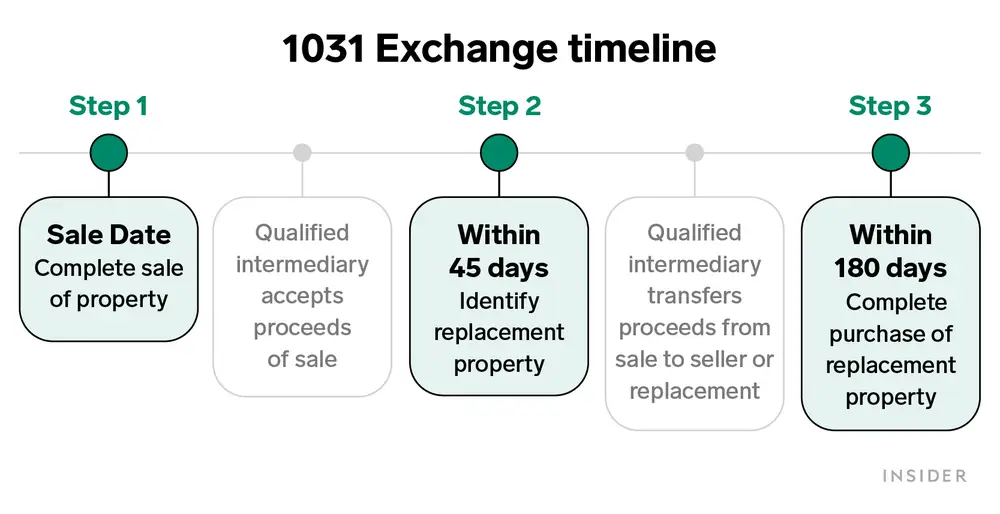

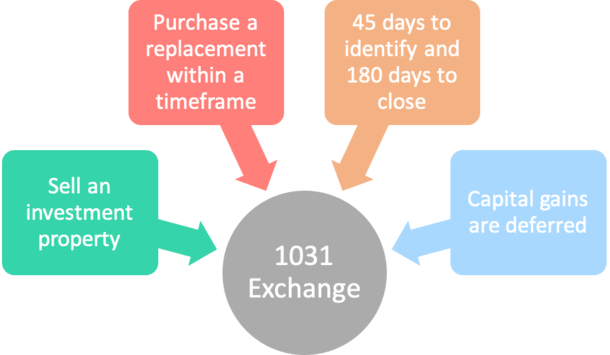

A 1031 tax-deferred exchange is a special deal where you and someone else trade properties of similar value. A 1031 exchange lets you sell your business property or investment and buy a similar property with the deferment of the capital gain taxes. Its important to keep in mind though that a 1031 exchange may.

Section 1031 of the Internal Revenue Code provides that no gain or loss shall be recognized on the exchange of property held for productive use in a trade or business or for. Also known as Like-Kind. A 1031 exchange lets you sell your business property or investment and buy a similar property with the deferment of the capital gain taxes.

The tax advantage with a 1031 exchange is a deferral. The 1031 tax-deferred exchange is a method of temporarily avoiding capital gains taxes on the sale of an investment or business. A section of the US.

After the Starker Case in 19791980 the 1031 Exchange became more. Gain deferred in a like-kind exchange under IRC. That means that property must be exchanged for other property rather than sold for cash.

A 1031 exchange allows you to defer capital gains tax thus freeing more capital for investment in the replacement property. You avoid having to claim a loss or gain on your taxes. Under Section 1031 of the United States Internal Revenue Code 26 USC.

In these cases they should consider whether they want to take advantage of a 1031 tax-deferred exchange. A 1031 exchange allows you to defer gains taxes on a property that you sell. The deferred 1031 exchange also known as a deferred Starker exchange is a tax-deferral strategy that can help you avoid a big tax bill upon the sale of your commercial property.

1031 Exchanges have been occurring for nearly 100 years. The exchange distinguishes an IRC 1031 tax deferred transaction from a taxable sale and. This means that when the reinvestment property is sold the deferred capital gain from the disposed property plus any.

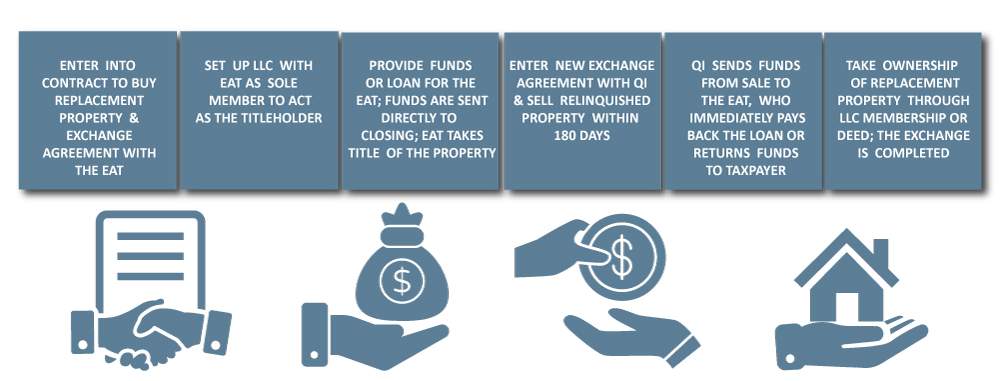

A 1031 Exchange is the swap of qualified like-kind real estate for other qualified like-kind real estate structured pursuant to 1031 of the Internal Revenue Code. A reverse exchange Refers to method of executing a tax-deferred exchange aka 1031 exchange or like-kind exchange in which the exchanger or taxpayer acquires the. If your long-term capital gains tax rate is 20 that means youd owe 60000 on the sale of that property.

A 1031 exchange is similar to a traditional IRA or 401k retirement plan. 1031 a taxpayer may defer recognition of capital gains and related federal income tax liability on the exchange. As with all of the tax deferral strategies there are certain rules to follow so that the strategy remains valid and.

Jobs Act of December 2017 prohibited personal property like franchise licenses. The tax deferred exchange as defined in 1031 of the Internal Revenue Code offers taxpayers one of the.

What Does 1031 Tax Deferred Exchange Mean To You Youtube

Reasons Not To Do A 1031 Exchange To Save On Taxes

1031 Exchange Guide For 2022 Tfs Properties

1031 Exchange The Basics The Source Weekly Bend Oregon

1031 Exchange Example Peak 1031 Exchange Services Los Angeles Peak 1031 Exchange

How To Do 1031 Exchange For Real Estate Property Guide

1031 Exchange Explained What Is A 1031 Exchange

1031 Exchange How You Can Avoid Or Offset Capital Gains

Is Your 1031 Exchange Under Attack John Parce Real Estate Key West

1031 Exchanges Understanding The Rules And Benefits For Real Estate Investors

1031 Tax Deferred Exchanges Building Wealth Through Real Estate Poulos Accounting

1031 Exchange Explained What Is A 1031 Exchange

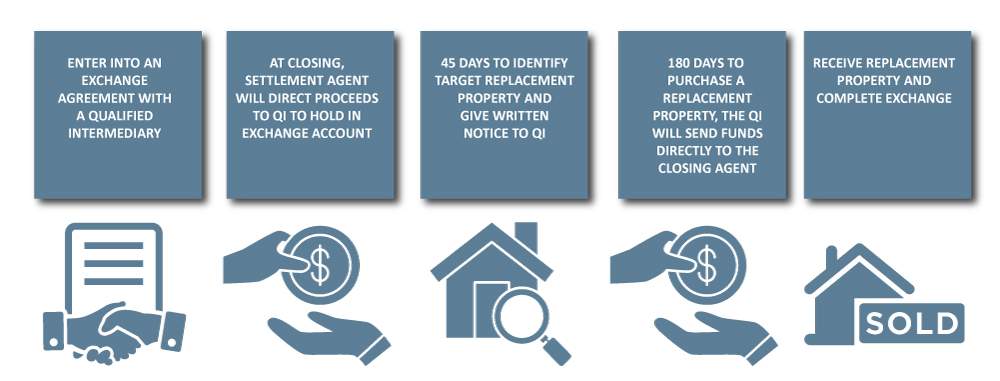

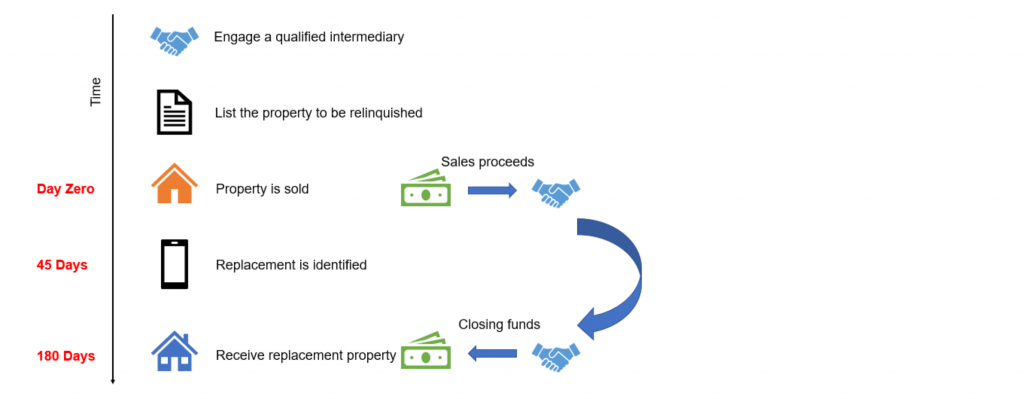

1031 Exchange Timeline How The Irs 1031 Exchange Process Works

What Is A Starker Exchange 1031 Exchange Experts Equity Advantage

Tips On 1031 Exchange Tax Rules For Cre Investors Wealth Management

1031 Exchanges Explained The Ultimate Guide Cws Capital

1031 Tax Deferred Real Estate Exchange Investmentbank Com

All About 1031 Tax Deferred Exchanges Real Estate Investment Tips Youtube